期货交易量与买入量的关系(期货交易量和持仓量的关系)

Understanding the Relationship Between Futures Trading Volume and Buying Activity

In the realm of financial markets, the dynamics between futures trading volume and buying activity play a crucial role in shaping market sentiment and price movements. This article delves into the intricate relationship between these two factors, shedding light on their implications for investors and traders alike.

Futures trading volume refers to the total number of contracts traded within a specific period, typically a trading session or a day. It serves as a barometer of market participation and liquidity, reflecting the level of interest and activity among market participants. High trading volume often signifies heightened market activity and increased investor engagement, while low volume may indicate a lack of interest or uncertainty prevailing in the market.

The Dynamics of Buying Activity

Buying activity, on the other hand, refers to the extent of investor interest in purchasing futures contracts. It is influenced by various factors, including market sentiment, economic indicators, geopolitical events, and individual investor preferences. When buying activity surges, it often reflects bullish sentiment prevailing in the market, with investors anticipating upward price movements. Conversely, a decline in buying activity may signal caution or bearish sentiment among market participants.

The Interplay Between Trading Volume and Buying Activity

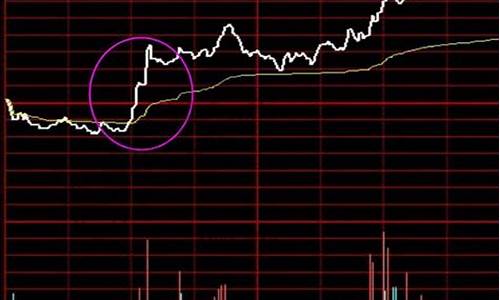

The relationship between futures trading volume and buying activity is intricate and multifaceted. High trading volume accompanied by increased buying activity suggests strong bullish sentiment and conviction among investors, potentially fueling upward price momentum. Conversely, high trading volume coupled with decreased buying activity could indicate divergent views among market participants, leading to heightened volatility and price fluctuations.

In summary, the relationship between futures trading volume and buying activity is a dynamic and nuanced one, influenced by a myriad of factors. Understanding this relationship is crucial for investors and traders seeking to navigate the complexities of the financial markets effectively. By monitoring both trading volume and buying activity, market participants can gain valuable insights into market sentiment and anticipate potential price movements, thereby making informed trading decisions.